vermont sales tax calculator

The Vermont sales tax rate is 6 as of 2022 with some cities and counties adding a local sales tax on top of the VT state sales tax. Rates include state county and city taxes.

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

The Vermont Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Vermont in the USA using average Sales Tax Rates andor specific Tax Rates by.

. The transfer of taxable tangible goods and services is subject to Vermont sales tax. Vermont has a 6. 2021 Property Tax Credit Calculator.

You can use our Vermont Sales Tax Calculator to look up sales tax rates in Vermont by address zip code. Before-tax price sale tax rate and final or after-tax price. The states top income tax rate of 875 is one of the highest in the nation.

Please contact us if you have questions on taxes or titles of motor vehicles in Vermont. The Vermont sales tax rate is currently. Just enter the five-digit zip code.

This is the total of state county and city sales tax rates. The items that are non-taxable are clothing groceries prescription and non-prescription drugs. Vermont state does have local sales tax so the total sales tax rate could include a combination of state county city jurisdictions and district tax rates.

Tax Year 2020 State of. The sales tax rate for Middlebury was updated for the 2020 tax year this is the current sales tax rate we are using in the Middlebury Vermont. Firstly divide the tax rate by 100.

The Vermont Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Vermont in the USA using average Sales Tax Rates andor specific Tax. Calculator Tue 02162021 - 1200. Theres also a 9 room tax.

The state sales tax rate in Vermont is 6. If the tax paid on an out-of-state registered vehicle was equal to or more than the. The calculator will show you the total sales tax amount as well as the county city.

Our calculator has recently been updated to include both the latest Federal Tax. Our Certified Software Makes It Easier to Manage Multi-State Tax Compliance. Calculator Mon 02082021 - 1200.

The latest sales tax rates for cities in Vermont VT state. To easily divide by 100 just move the decimal point two spaces to the left. Vermont Documentation Fees.

Ad Your Business Can Automate Sales Tax and File Returns for Free in 24 States with Avalara. Local tax rates in Vermont range from 0 to 1 making the sales tax range in Vermont 6 to 7. Sales of prewritten computer software have been subject to sales tax in Vermont since July 1 2014.

The average cumulative sales tax rate in South Newfane Vermont is 6. Now find the tax value by multiplying. Find your Vermont combined state and local.

Exemptions to the Vermont sales tax will vary by state. The minimum combined 2022 sales tax rate for Fayston Vermont is. Ad Your Business Can Automate Sales Tax and File Returns for Free in 24 States with Avalara.

Average DMV fees in Vermont on a new-car purchase add up to 70 1 which includes the title registration and plate fees shown above. Sales tax in Middlebury Vermont is currently 7. Vermont has a progressive state income tax system with four brackets.

You are able to use our Vermont State Tax Calculator to calculate your total tax costs in the tax year 202122. 2020 rates included for use while preparing your income tax deduction. 2020 IN-152A Annualized VEP Calculator.

Overview of Vermont Taxes. 75100 0075 tax rate as a decimal. Credit will be given for the purchase and use or sales tax paid on this vehicle to another jurisdiction.

The most populous zip. The base state sales tax rate in Vermont is 6. The County sales tax.

This includes the sales tax rates on the state county city and special levels. Our Certified Software Makes It Easier to Manage Multi-State Tax Compliance. Well speaking of Vermont the rate of the general sales tax is 6.

54 rows The Sales Tax Calculator can compute any one of the following given inputs for the remaining two. As far as cities towns and locations go the place with the highest sales tax rate is Manchester and the place with the lowest sales tax rate is White River Junction.

New York Sales Tax Calculator Reverse Sales Dremployee

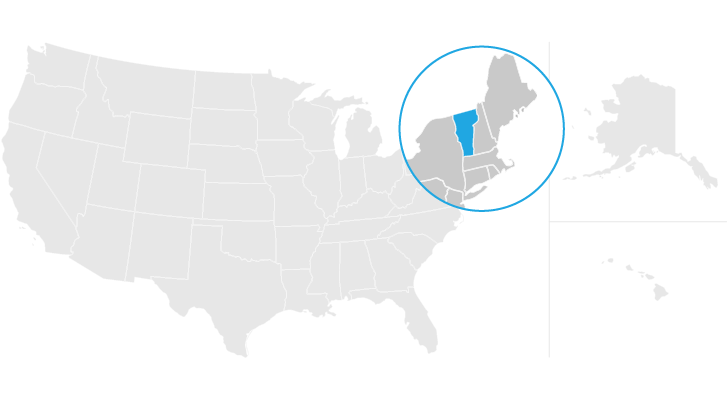

Vermont Sales Tax Rates By City County 2022

Sales Taxes In The United States Wikiwand

Vermont Sales Tax Guide And Calculator 2022 Taxjar

Taxjar State Sales Tax Calculator Sales Tax Tax Nexus

Vermont Sales Tax Small Business Guide Truic

Vermont Sales Tax Information Sales Tax Rates And Deadlines

Vermont Real Estate Transfer Taxes An In Depth Guide

Where S My Refund Vermont H R Block

Vermont Income Tax Calculator Smartasset

Vermont Estate Tax Everything You Need To Know Smartasset

Vermont Income Tax Calculator Smartasset

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

States With Highest And Lowest Sales Tax Rates

How To Register For A Sales Tax Permit Taxjar

Vermont Property Tax Rates Nancy Jenkins Real Estate

Vermont Income Tax Calculator Smartasset